Honourable Speaker, Nosiviwe Mapisa-Nqakula

His Excellency, President Cyril Ramaphosa

His Excellency, the Deputy President Paul Mashatile

Cabinet Colleagues

Members of the Executive Committees for Finance

Honourable Members

The Governor of the South African Reserve Bank

The Commissioner of the South African Revenue

Service

Fellow South Africans

Introduction

As stated by eminent economists Dani Rodrik and Alberto Alesina, “a crude distinction between economics and politics would be that politics is about distributing it while economics is concerned with expanding the pie,” Madam Speaker.

The idea here, Madam Speaker, is that the realization of our political mandate of redistribution is ultimately determined by the size and quality of the national pie.

For the past thirty years, our goal has been to bring social and economic justice back to our country and to aggressively combat the inequalities that served as the foundation for systematic discrimination and dispossession.

Since 1994, the budgets we have proposed have focused on achieving the objective of expanding the economy, enabling us to take more action against the poverty and inequality that continue to plague our society and threaten the ideals of democracy.

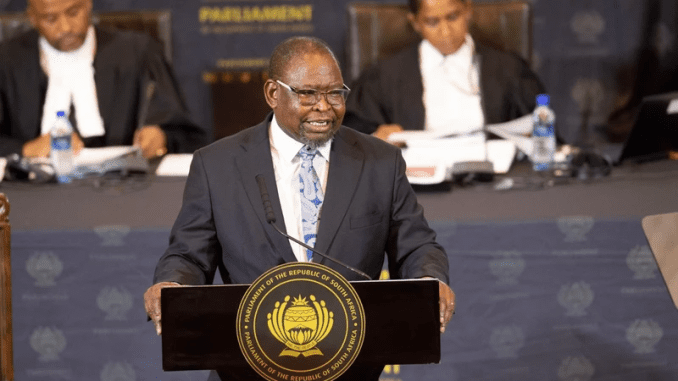

Therefore, I stand before you to deliver this final budget of the sixth democratic administration with a profound sense of privilege and purpose.

As a result, Madam Speaker, I provide the following documents to the House:

The 2024 Budget Review;

- The 2024 Division of Revenue Bill;

- The 2024 Appropriation Bill;

- The Estimates of National Expenditure;

- The 2024 Budget Review;

- The 2024 Fiscal Framework;

- The Second Adjustments Appropriation Bill;

- The Budget Speech; and

- The Gold and Foreign Exchange Contingency Reserve Account Adjustment Bill

Economic OUTLOOK

International Outlook

Permit me to start with the world outlook, Madam Speaker. Global growth is expected to accelerate, rising from 3.1% this year to 3.2% in 2025.

The rise of the US economy and a number of other emerging economies is to blame for the modest improvement.

Risks to the negative include the possibility of increases in the price of oil globally, the escalation of the Middle East conflict, and a slowdown in China’s economy, which is the nation’s main trading partner.

DOMESTIC OUTLOOK

South Africa’s near-term development is nevertheless constrained by lower commodity prices and structural limitations, even with the improved global forecast for 2024.

In 2023, real GDP growth is projected to be 0.6%. This represents a decrease from the 0.8% growth predicted by the 2023 MTBPS.

The third quarter of 2023’s lower-than-expected results, notably in fixed investment and household spending, are the cause of the change.

Growth is anticipated to average 1.6% between 2024 and 2026.

The anticipated reduction in power outages as new energy projects start up, along with lower inflation supporting consumer consumption and loan extension, all support the GDP prognosis.

However, the domestic outlook is not without peril. These include a significant sovereign credit risk as well as ongoing limitations in the ports, freight rail, and electrical supplies.

Honorable members, we face the dilemma that the pie is not expanding quickly enough to accommodate our demands as we progress.

FINANCIAL OVERVIEW AND APPROACH

Therefore, our fiscal plan ensures budgetary sustainability while promoting economic growth and lowering economic risks.

The budget deficit for 2023–2024 is predicted to increase from 4% to 4.9% of GDP in comparison to the same period last year.

The projected increase in debt-service costs for 2023–2024 is R15.7 billion, or R356 billion, due to the larger budget deficit.

Over twenty percent of revenue will be consumed by debt servicing expenses. To put this into perspective, the amount spent on debt service is higher than what is allocated to the budgets for peace and security, health care, and social protection alone.

Because of this, Honorable Members, we are maintaining our financial targets and fortifying our plan.

Over the medium term, a net reduction of R80.6 billion in non-interest expenses is being implemented. In addition, revenue has been adjusted higher over the medium term by R45.6 billion in comparison to 2023 MTBPS. Furthermore, we have decided to implement a reform of the GFECRA, or Gold and Foreign Exchange Contingency Reserve Account.

When combined, the national government’s gross borrowing requirement will drop from R457.7 billion in 2024–2025 to R428.5 billion in 2026–2027—even with the spending increases I will disclose later. Starting in 2024–2025, the deficit is expected to decrease to 4.5% of GDP, with a final percentage of 3.3% by 2026–2027.

The highest debt to GDP ratio, as of right present, is 75.3% in 2025–2026.

We are now in a position to keep defending essential services because of all of this. The social wage can receive sixty percent of non-interest spending. We can also maintain capital expenditures thanks to it.

We are adding R57.6 billion in comparison to the MTBPS to cover the salaries of physicians, nurses, and teachers, among many other essential services.

As I previously stated, Madam Speaker, we are announcing a GFECRA change in this budget. Gains and losses on the nation’s foreign currency reserve operations are recorded in the Reserve Bank account GFECRA.

It is as simple as this: the account balance decreases and vice versa if the Rand gains strength versus the US Dollar and other reserve currencies. Because of the depreciation of the Rand over time, the account balance has increased to nearly R500 billion.

In order to lower government borrowing and strengthen the Reserve Bank’s equity position, a new settlement agreement is being implemented.

In the end, we are guaranteeing alignment with global best practices and moving South Africa closer to our counterparts. The GFECRA balance of R150 billion will be deducted once we have confirmed that there are adequate buffers to absorb fluctuations in exchange rates and that the Reserve Bank’s solvency is unaffected.

HELPING THE ECONOMIC GROWTH

We have started a comprehensive structural reform program with the goal of resolving the issues that have impeded our growth.

Reforms pertaining to visas, electricity, water, logistics, and telecommunications have all been included in this agenda. The excellent advancements in these areas over the last few years are described in detail in the Budget Review.

But there are still challenges; allow me to concentrate on the two biggest ones.

POWER

Every South African faces the challenge of load shedding. Production, activities, and livelihoods are disrupted.

Energy security over the long run will be achieved through sector reform. Over the last five years, we have made the required decisions, and they are paying off.

This budget suggests raising the maximum amount of renewable energy projects that can be eligible for the carbon offsets system from 15 megawatts to 30 megawatts in order to encourage additional investments in renewable energy.

Eskom is still a major participant in the electrical industry. Also, the debt alleviation plan enables the organization to concentrate on its main activity.

Next week, we will make public the findings of the independent assessment of Eskom’s coal-fired power plants. The evaluation was conducted in order to provide input for one of the requirements of the debt reduction plan.

The suggestions will be included into Eskom’s corporate strategies to improve supervision and accountability.

VIEW THE 2024 BUDGET SPEECH BELOW:

There are rumors that Godongwana plans to raise the fuel charge and the R350 SRD grant ahead of the budget speech, which would mean additional suffering for drivers at the gas pump.

Additionally, a number of political parties have stated what they anticipate:

The low economic growth challenge facing the nation should be the main topic of Godongwana’s budget speech, according to MP and secretary-general of the Good Party Brett Herron.

Herman Mashaba, president of ActionSA, believes that Godongwana ought to increase financing for higher education.

MP Steve Swart of the African Christian Democratic Party (ACDP) stated that billions of rands taken by the state have to be returned.

Owners of small, micro, and medium-sized businesses (SMME) have also been urged to listen to the address.

“Various interventions were announced during the 2023 Budget Speech, enabling businesses to reduce their taxable income by 125% for the cost of investment in renewable energy generation projects,” explains Andiswa Bata, head of SME at FNB Commercial.

Leave a Reply